“Exorbitant privilege” of USD becoming a thing of the past?

SL Kanthan, Dec 24

Since the Bretton Woods agreement of 1944, Europeans and other developing nations have complained about the exorbitant privilege and tyranny of the US dollar. As the preferred currency of global trade and foreign exchange reserves, the USD bestows extraordinary power and wealth to Americans. However, in their desperation to sustain this unfair advantage, American elites have been weaponizing the dollar and the associated financial systems such as the SWIFT. Now, the world is revolting – including even allies – and the future of dollar looks bleak. The democratization of finance and a system of truly free trade are emerging. Ladies and gentlemen, put on your seat belts, it’s gonna be a wild ride!

What’s the Problem with Dollar?

Rather than creating a basket of currencies of different nations — which would be democratic — the world has meekly accepted the US dollar as the king, with the Euro being the prince. What does this mean?

*1. The power to sanction and cripple countries and corporations

All the commodities in the world are priced – and mostly sold – in US dollar. This means that countries need to get hold of and accumulate US dollars (which will be held in US banks). For example, India needs US dollars if it wants to buy oil from Saudi Arabia or electronics from China. This is the so-called Petrodollar regime.

Over the decades, the US has abused this power to extend its empire. If you don’t bow to America, you will be sanctioned, and you cannot trade with other countries. Iran, Venezuela, North Korea etc. are good examples, but the US also sanctions people and corporations from all over the world, even European ones. For example, when EU banks helped EU corporations work with Iran using Euros, those banks were still sanctioned and fined by the US! (However, the reverse cannot happen — you don’t see other countries dictating to America).

And if a country found ways or even thought about ditching the dollar, the US intelligence will stage a coup or the US military will start dropping freedom bombs. Ask Saddam Hussein, who started selling oil for Euros in 2000. One year later, the US falsely linked him to the 9/11 attack, and the rest is history. Libya and Syria are also similar victims of refusing to bow to the US.

Thanks for reading India and Geopolitics ! Subscribe for free to receive new posts and support my work.Subscribe

*2. Stealing FOREX, Gold etc.

The US and NATO kept arming Ukraine until Russia had no other choice but to invade. Then, using that as an excuse, the US and the EU stole about $400 billion worth of Russia foreign exchange reserves. The West has done this to many other countries. Sometimes, the gold is also stolen, since it is often kept in the vaults in New York or London for “protection.”

*3. Carrots for Leaders

But it’s not all sticks. Leaders around the world – especially those from developing nations – get to funnel all their dark money into Western banks in Switzerland, Caribbean, Panama, London, New York etc. So, an African or a Latin American leader who sells mines of Lithium or gold to Western corporations for pennies on the dollar can squirrel away tens of millions in US dollars in far way banks. Or, it could be Indian leaders who let the US monopolize e-commerce and tech sectors. Of course, if the leaders misbehave later on, their assets in those offshore banks will be seized. This is why leaders around the world kowtow to America’s diktats and rarely speak up.

*4. Debt Trap

While the US has been crying about China’s debt trap, it’s the Western bankers who mastered international debt traps. You could see that in the recent events in Sri Lanka, Pakistan, Argentina etc. When poor countries go through an economic shock, the vultures of Wall Street descend upon them and destroy their currencies and bonds. Then, these countries are forced to go beg to the IMF and the World Bank, who will come and say, “You need reforms. That means slashing government spending, getting rid of labor protections, imposing austerity on people, and privatizing your natural resources, utilities, industrial sectors, and financial systems. In other words, sell your country to foreign companies at a discount.” This is how the US dollar enables modern colonialism. (This neoliberal shock therapy was applied to the extreme in Russia in the 1990s to deliberately devastate the country).

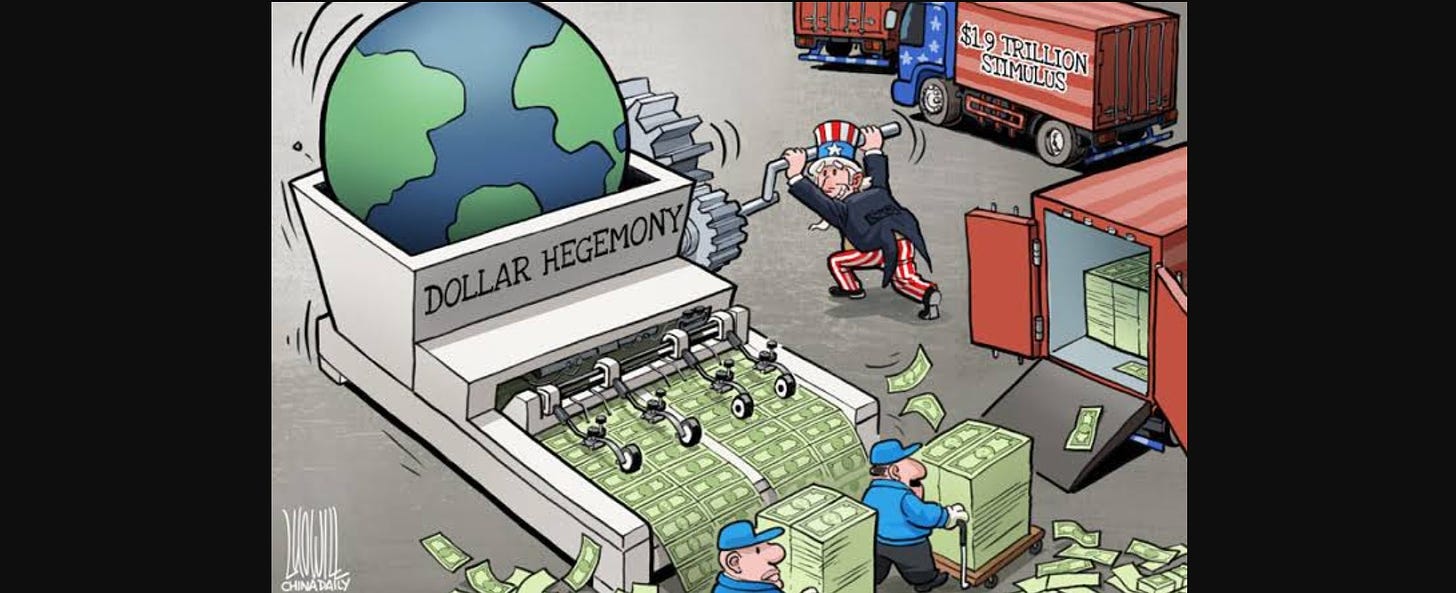

*5. US printing dollars

The biggest of all travesties is that the US can print money, while others have to slave away to earn dollar. Poorer countries have to sell their natural resources and/or labor to earn some dollar, which will be used to buy essentials like oil or even food. And countries like Saudi Arabia, Kuwait and Qatar, which accumulate a lot of dollars are also occupied/colonized by the US!

Why? To make sure that these Arab nations don’t get too wealthy. Hence the recycling of dollar — these countries give back their dollars to the US by purchasing US debt, buying US weapons, paying for US military bases etc. In return, the US military “protects” them — very similar to the Mafia’s protection racket.

While developing countries need to assiduously grow and protect their foreign exchange reserves, the US has no FOREX! It can create trillions of dollars out of thin air. Interestingly, the value of dollar doesn’t go down much; or like during COVID – when the FED printed $5 trillion – the dollar’s value actually went up! Voodoo economics.

What’s Happening Now?

This dollar’s tyranny worked well as long as the US had many other things to offer, such as goods that people need. However, thanks to globalization, many other countries have climbed up the value chain. If you want to buy clothes, household appliances, electronic gadgets, automobiles, smartphones, solar panels etc., the US is not the #1 choice anymore.

China, for example, can make pretty much anything that the US makes or used to make. Increasingly, China is making things that the US cannot make at scale or at all.

Consider that Eurasia — Europe + Asia — now accounts for 75% of global trade. America is becoming more irrelevant every day.

(This is why the US fueled the war in Ukraine. Dividing Russia and Europe is a big priority. Dividing India and China is also very crucial for America’s hegemony).

World outside USD and SWIFT

However, America’s Machiavellian strategies are starting to backfire. The extraordinary economic war on Russia, for example, has accelerated de-dollarization. Russia is now selling oil and natural gas for Yuan and Rubles; in the Russian currency exchange market, people are trading Yuan more than USD; Russian banks are allowing corporations to open Yuan accounts for easy trade with China; and Yuan has become the #1 currency in Russia’s FOREX. Even India is buying Russian coal with Yuan.

Thanks to technology – including blockchain – Russia and China have established their own alternative systems to circumvent SWIFT. The Russian and Chinese systems are known as SPFS and CIPS respectively.

Many countries in Asia – Malaysia, Indonesia, Singapore and Thailand – are also using local currencies to trade with one another. India is pushing Rupee-trade with oil exporters like the UAE.

Another way to avoid the US dollar is the ancient barter system — oil for food, natural gas for pharmaceuticals and so on.

The biggest shock news was when Xi Jinping went to Saudi Arabia earlier this month and told 20 Arab leaders that they can sell oil for Yuan! While it will happen only in small steps, the Petroyuan will significantly weaken the Petrodollar. After all, China is the world’s #1 importer of oil.

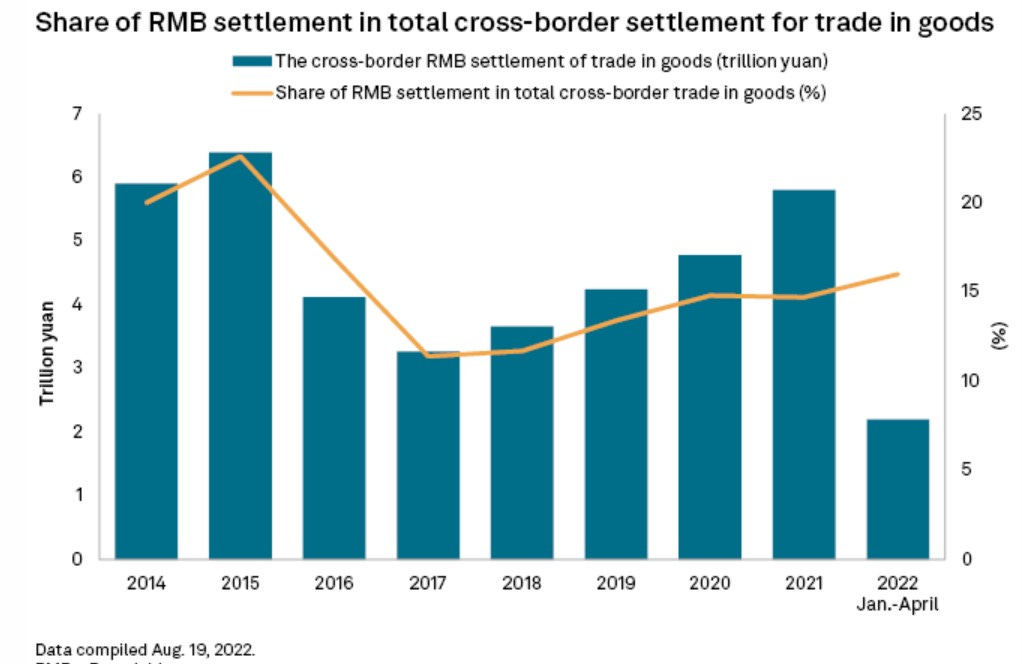

Already, iron ore companies in Brazil and even Australia are accepting Yuan for payments. In fact, 15% of China’s goods trade are now happening in Yuan. Goodbye, dollar!

China has apps like AliPay and WeChat Pay that are enabling quick and easy cross-border transactions, which will amount to 40 TRILLION Yuan this year. That’s $6 trillion of lost dollar transactions for the US.

Billionaire and hedge fund owner Ray Dalio talks about how the currency of the world’s biggest trading nation always had the global currency. Now, consider China.

China is the biggest trading country — it is the world’s #1 exporter and #1 importer. And China is also the #1 trade partner for 135 countries. My prediction is that China will also surpass the US in nominal GDP within 5-7 years. Imagine if China dumps the US dollar and moves to Yuan, even if partially — say, for half of all the trades. The impact will be seismic in geopolitics and global finance.

Another option is for the BRICS group to expand to include countries like Saudi Arabia, and then create a basket of currencies. That will be more democratic. They could even add some gold, oil and wheat to this basket to create a combo basket of fiat and commodities to add stability.

Conclusion

America hyperventilates about freedom and democracy but practices neither in foreign policy. The US also talks about “rules-based order,” but nobody has seen those rules. The American Empire is above all the morals and rules that it preaches.

The US dollar still dominates the global trade and foreign reserves. However, think about how Facebook replaced MySpace or how TikTok has surpassed Instagram and YouTube. The currency world is a lot like social media with a Catch-22 challenge. Nobody wants to use a currency that nobody uses; and everybody wants a currency that everyone uses.

In this case, everybody is looking for a new solution for an old problem.

The spark has started and it will soon be a fire that will engulf dollar hegemony. The US dollar won’t go away but the American tyranny will be gone.

The Rothschild magazine Economist predicted in 1988 that there will be a world currency by 2018. They were right about the eventual dethroning of US dollar but totally missed the rise of a multipolar world.

— S.L. Kanthan